michigan sales tax exemption nonprofit

Tax exemption is a major advantage of becoming a 501c3 classified nonprofit. States like Arkansas Kentucky and Michigan among others do not exempt government contractors purchases in such cases.

A customer living in Cary North Carolina finds Steves eBay page and purchases a 350 pair of headphones.

. Some states will exempt sales only substantiated by a government purchase order. When calculating the sales tax for this purchase Steve applies the 475 tax rate for North Carolina plus 2 for Wake Countys tax rate and. Flow-Through Entity Tax payments became available December 29th 2021Please visit Michigan Treasury Online and go through the Fast Pay option under Guest Services to make your payment.

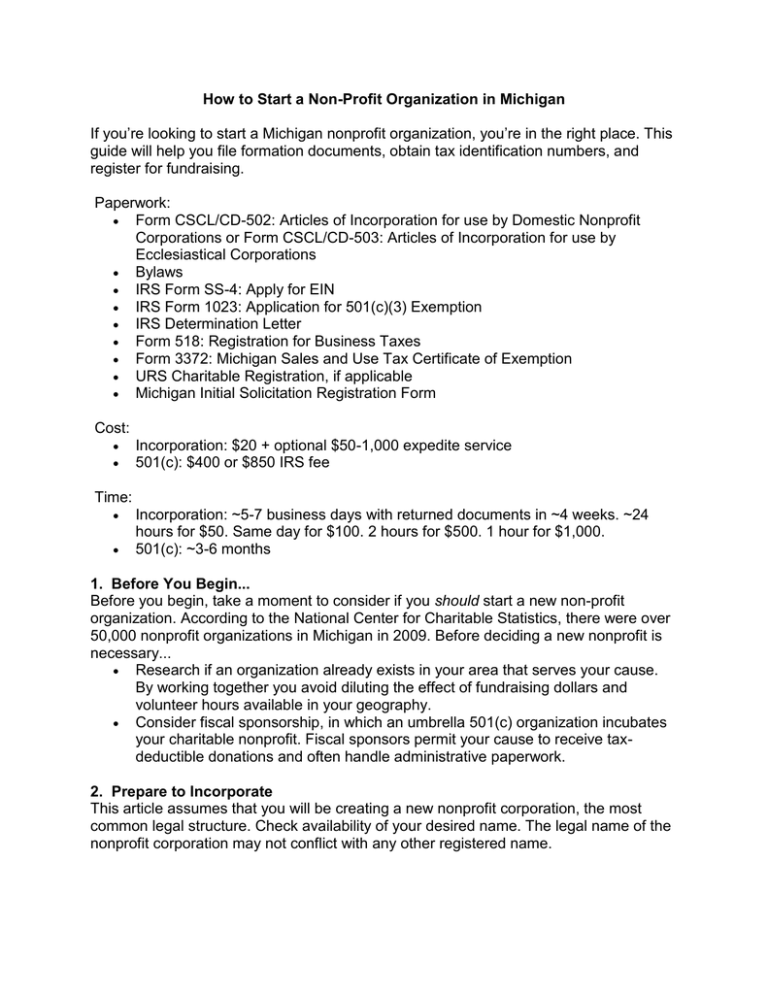

A nonprofit can also receive discounts on postage and advertising rates which makes for more efficient operation. Nonprofits that are tax-exempt typically dont pay income tax on any money they acquire through activities related to their purpose like fundraising. How to apply for a state resale.

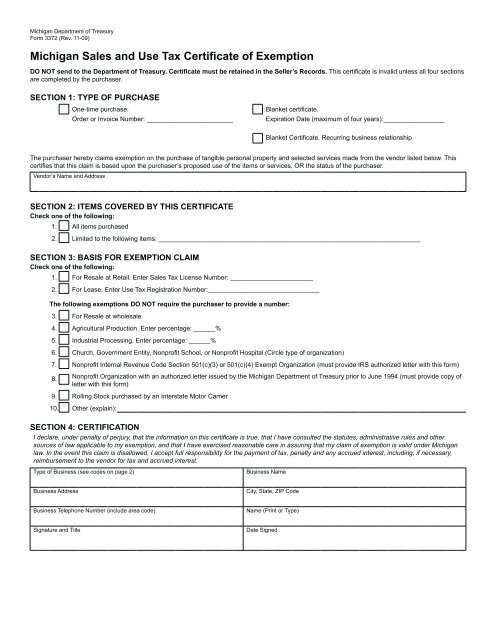

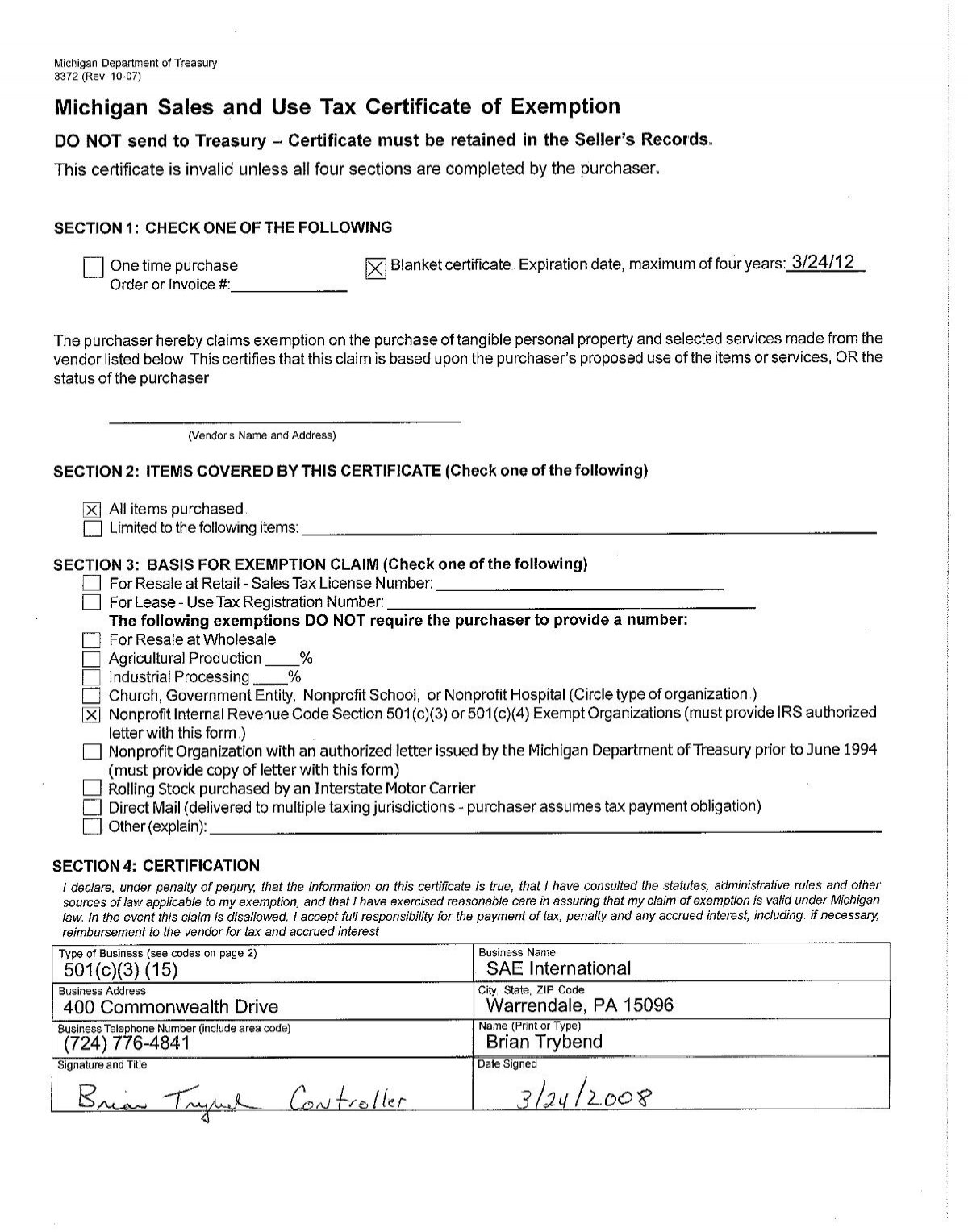

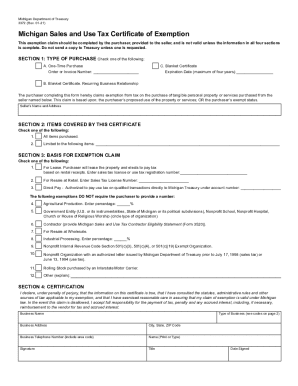

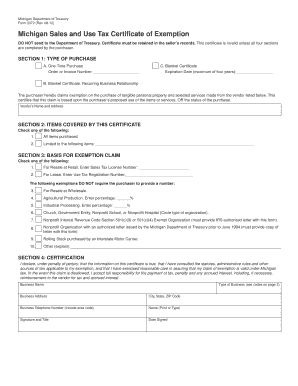

To claim this exemption with each vendorseller submit a completed Certificate of Exemption Form 3372 with a copy of the IRS 501c3 determination letter. Once an organization is tax-exempt any charitable donations made by individuals are tax-deductible. For all sales to the Federal Government evidence of the sale must be retained in order to claim the exemption.

Organizations exempted by statute organizations granted exemption from Federal income tax under the Internal Revenue Code section 501c3 or 501c4 or organizations that had previously received an exemption letter from the Michigan Dept. Others will permit an exemption for. Remember that a sales tax exemption certificate does not apply to every purchase you make for your business.

It does not count toward items you use throughout the usual course of business. IRS exempt nonprofits are also automatically exempt from Michigan sales and use tax. Nonprofit organizations can qualify for a tax-exempt status but this isnt the same as a sales tax exemption certificate.

They also generally dont have to pay sales tax on purchases they make for their business activities. Of Treasury are entitled to sales and use tax exemption. Please contact 517-636-6925 follow the prompts for the Corporate Income TaxFlow-Through Entity Tax for any questions related to Flow-Through Entity Tax.

There are many advantages to becoming a nonprofit. At a total sales tax rate of 675 the total cost is 37363 2363 sales tax. Once you have your federal tax exemption you are automatically exempt from Michigan state income tax.

For example a nonprofit organization would need to apply for 501c3 status and then apply for sales tax exemption.

Mi Sales Tax Exemption Form Animart

How To Start A Nonprofit Step By Step

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Fillable Online Michigan Form 3372 Fax Email Print Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption

Sales Tax License Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Small Business Guide Truic

Michigan Sales Tax Complexities For Nonprofits Yeo And Yeo

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller